Many businesses needlessly lose thousands of dollars to credit card processing fees every single year.

In many cases, these figures are in the ballpark of at least $4,000+ or more. Over a period of five years, you could be overpaying by $25,000 dollars (and likely much more than that!). This is due to having the wrong pricing model for your business as well as higher processing costs and hidden fees like international fees.

It’s exactly why we launched Yocale Pay: to reduce unnecessarily high payment processing costs.

If you’re looking to choose a payment processor (or if you’re looking to make a switch), we’ll do a comparison of the most common options to see where you might be overpaying.

Credit Card Payment Processors: Comparison Chart

1. Pricing Model: Interchange-Plus Pricing, Flat Rate or Tiered Pricing

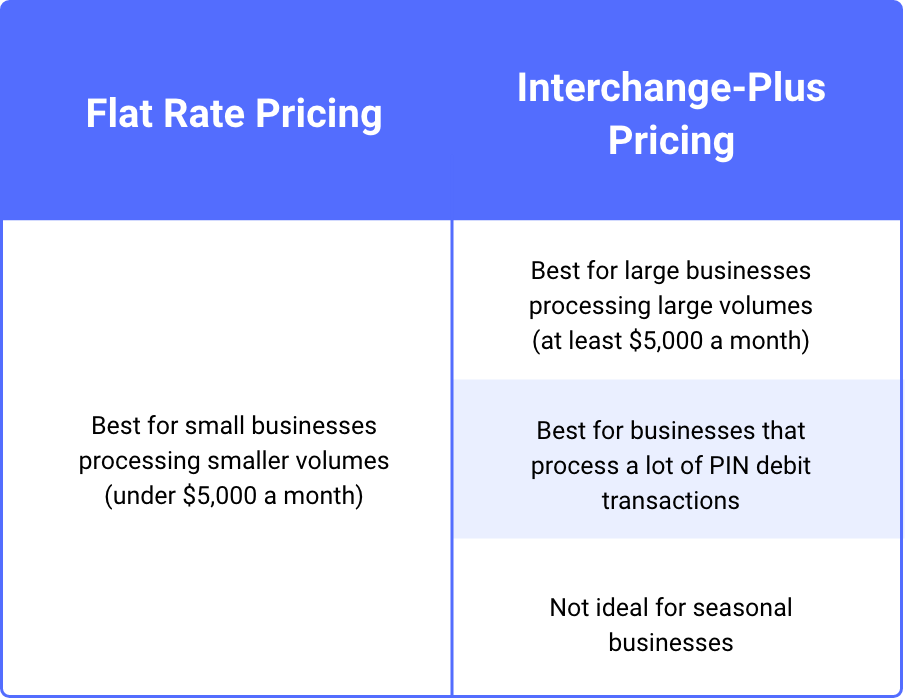

Before you ever compare actual processing rates, the single most important thing you can do when choosing (or switching to) a payment processor is to choose the right pricing model for your business.

The three standard models are interchange-plus pricing, flat rate pricing and tiered pricing (although we recommend avoiding tiered pricing altogether).

In a nutshell, interchange-plus pricing charges you the true interchange fee, which actually varies based on the type of card you’re processing and the industry your business is in. If you’re paying a flat fee, you pay the same fee regardless, which can lead to overspending depending upon your business.

In the chart below, you’ll see what type of pricing model is best for your business.

2. Processing Fees

In addition to the pricing model, the next thing to consider is the processing rate.

While we acknowledge our bias, Yocale Pay offers wholesale rates, which means our rates are the lowest in the industry – regardless of whether you’re on a flat rate pricing plan or interchange-plus.

Given that most payment processors only offer a flat-rate model, the comparison below will compare flat rate pricing across several processors.

*Rates based on October 2021 data*

| Stripe | 2.9% + $0.30 |

| PayPal | 2.9% + fixed fee based on currency ($0.30 UDS) |

| Square | 2.65% + $0.15 keyed-in |

| Mindbody | 2.75% + chargeback fees |

| Vagaro | 3.5% + $0.15 keyed-in |

| Schedulicity Pay | 0.25% + $0.15 |

| Yocale Pay | True Interchange Rate + 0.25% |

3. Additional Fees (Card Readers, Hidden Costs)

In addition to processing fees, there are additional fees that can be associated with payment processors. This includes costs for card readers (whether to buy the point of sale or to rent it) as well as fees that aren’t so obvious but which you should watch out for. We like to call these “hidden fees,” and they include fees for international cards, PCI non-compliance fees, non-qualified fees, cancelation fees or American Express surcharge fees to name a few.

One thing to watch out for is signing any contracts. Some payment processors will require that you sign two separate agreements – one for payment processing and one for leasing equipment; the equipment lease contract can be as many as 48 months (or four years!) long. The problem is that not only do you have to pay a cancelation fee for the primary contract if you decide to cancel, you’ll also be forced to purchase the hardware outright. You can get more insight into some processors’ cancelation requirements here.

Yocale Pay is based on completely transparent payment processing: zero hidden fees.

4. Contract Requirements and Next-Day Funding

As you saw above, it’s also important to consider things like contract requirements as well as next-day funding. Next-day funding can also be a source of additional fees:

| Processor | Contract Requirements | Next Day Funding |

|---|---|---|

| Stripe | No | Yes (for an additional fee) |

| PayPal | No | Yes (for an additional fee) |

| Square | No | Yes |

| Mindbody | Subscription Terms | No |

| Vagaro | No | No |

| Schedulicity Pay | No | Yes |

| Yocale Pay | No | Yes |

Wrapping it Up

Your payment processor – or merchant services provider – is an important consideration. The wrong processor could cost you thousands of dollars every single year.

TLDR:

- The wrong pricing model could cost you $4,000 a year. If you process under $5,000 a year, flat rate pricing is best while interchange-plus is best for businesses processing higher volumes.

- The next important consideration is the processing rate. Yocale Pay is the only payment processor home to wholesale rates.

- Watch out for additional fees like card readers as well as hidden fees such as international fees, cancelation fees or American Express surcharges.

- Be wary of signing any contracts, and also watch out for additional fees associated with next-day funding.

Interested in learning more about Yocale Pay? Contact us here.