Summary: Your choice of pricing model is super important when choosing your payment processor. The wrong model may be costing you thousands of dollars every year. If you process high volumes, interchange plus pricing is best for your business.

When it comes to payment processing, most business owners naturally focus on the rate they’re getting. While this is important, there is another critical component that often gets overlooked: the pricing model (interchange plus pricing, tiered or flat rate pricing models).

Tiered and flat rate models are typically the industry standards, but interchange plus (also known as cost-plus, pass-through pricing or interchange++) is becoming increasingly popular and even the gold standard, particularly for businesses who are processing higher volumes. Interestingly, interchange plus used to be exclusively offered to these higher-volume businesses, but that’s not the case now.

At the end of the day, not all pricing models are best for all businesses. The best pricing model actually depends upon the size of your business and your processing volume. Many business owners end up overpaying. In fact, the wrong payment processing pricing model could be costing you as much as $4,000 a year.

In this blog post, we’ll discuss interchange plus pricing but also how it compares to other pricing models like tiered and flat rate models and what the best pricing model is best for your business.

How Do You Explain Interchange Plus Pricing? What is Interchange Plus Pricing?

Interchange plus pricing is often referred to as the “transparent” pricing model. Another way to think of interchange plus is that it’s a wholesale pricing model. In order to explain what interchange plus pricing is, though, it’s first necessary to understand how credit card processing fees work in general.

How Credit Card Processing Fees Work:

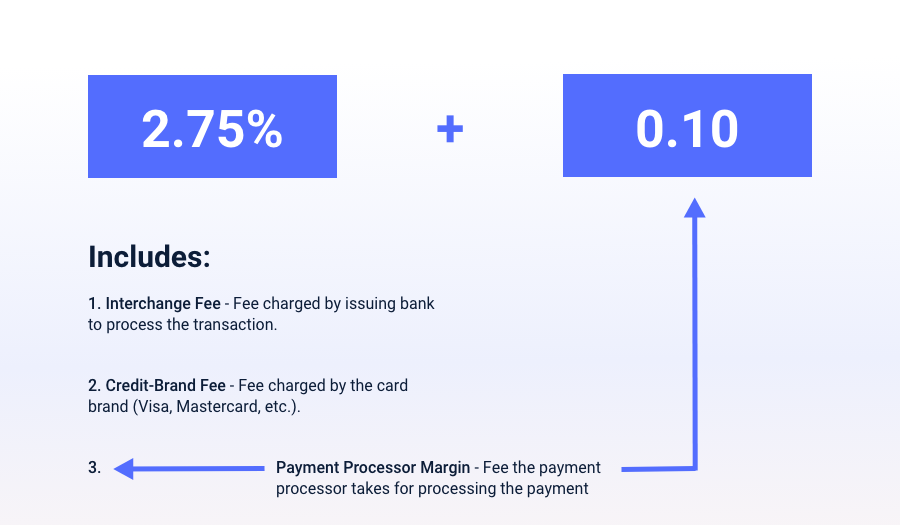

It’s not always clear, but the transaction fee that you pay to process debit and credit cards is actually made up of three fees. This includes:

- Your payment processor’s margin (i.e. Yocale, Square, Moneris, Elavon, Chase, TD)

- The card brand fee (Visa, Mastercard)

- The interchange fee (charged by the bank issuing the card, such as the Bank of America, TD, Wells, Fargo, CIBC, etc.)

How Does Interchange Plus Credit Card Processing Work?

The interchange fee (which are fees set by credit card associations like Visa and Mastercard and get paid to your issuing bank) is the fee that’s most important to understand when it comes to interchange plus pricing – and specifically the fact that the interchange fee is actually variable and changes at every transaction.

Although there are numerous factors that will influence what the interchange fee will be, a big one is the type of cards that are used – i.e. whether a credit card or debit card was used. More premium cards, for example, have higher interchange fees, while debit cards typically have lower interchange fees.

Therefore, with interchange plus pricing, you only pay the true interchange rate (plus the payment processing margin). This makes it different from other models like flat rate pricing because in this model, the interchange rate gets “bundled” into one flat rate. While this is beneficial for forecasting your monthly processing fees, it can be negative if you process high volumes.

An Example of Interchange Plus Pricing

Here’s an example of how interchange plus pricing works in practice:

Let’s assume that you’re a hair salon owner.

A client has just had a hair cut, totaling $100.00, and the interchange fee is 1.65% + $0.05, or a total of $1.70. Your payment processor will pass this cost directly over to you while also charging a markup of 0.30% + $0.05, or $0.35. In this example, the client would pay $2.05 (or 2.05%) in total.

This has an advantage over a flat rate, which would charge you a flat rate for the interchange fee. For example, a traditional flat rate processor may charge a flat rate of 2.45% + $0.10 for a total of $2.55 (or 2.55%) in total, for 50 cents more per transaction.

Reduce your payment processing fees by 30% with Yocale Pay

Why Does Interchange Differ?

As you saw above, the interchange fee differs depending upon a wide variety of factors and is mostly based on the amount of risk present. While the type of card (i.e. credit card or debit) is important, there are other factors, including:

- Card brand (Visa or Mastercard)

- Card type (rewards card, corporate card or foreign card)

- Card-present or not-present (i.e. in-person or online purchases)

- Type of business

- Region

How Do You Calculate Interchange Plus?

Interchange plus pricing is based on the following quote: Interchange + X% (percentage-based markup) + $Y (fixed mark-up)

Remember that interchange fees are created by credit card brands and cannot be negotiated (Visa interchange rates here) and Mastercard (Mastercard interchange rates here).

That said, the processor markup can vary depending upon several different factors. For instance, if you process a lot of volume, you’ll likely pay a lower margin. In contrast, you may pay a higher markup if you process a lot of online payments given that these are thought of as less secure compared to purchases that are made in person.

On average, though, business owners will pay somewhere around 2.2% + $0.22 with interchange plus pricing.

How Does Interchange Plus Pricing Compare to Other Pricing Models?

Interchange Plus vs Tiered Pricing

Tiered pricing still does remain the most common pricing model.

With tiered pricing, transaction rates are based on three tiers. This includes qualified cards, mid-qualified cards and non-qualified cards. These tiers depend on a variety of different factors that are determined by the credit card processor. This includes whether the card is present or not present and whether the transaction was processed on the same day it occurred, among other factors.

While this offers greater transparency compared to flat rate pricing (more on this to come), it’s still difficult to truly understand how much is going to the issuing bank, how much is going to the credit card associations and how much is going to the payment processor.

Another thing to be mindful of when it comes to tiered pricing is that while the advertised rate may seem low, the rate typically only applies to qualified cards. In reality, only a small percentage of your transactions may be qualified.

Interchange Plus vs Flat (Fixed) Rate:

Flat rate (also known as fixed or blended pricing) is the simplest pricing model to understand out of the three because you only pay one flat fee regardless of whether debit cards or more premium cards like Amex Black were used.

(That said, most payment processors do offer separate rates depending on if the purchase is made in-person, online or keyed-in).

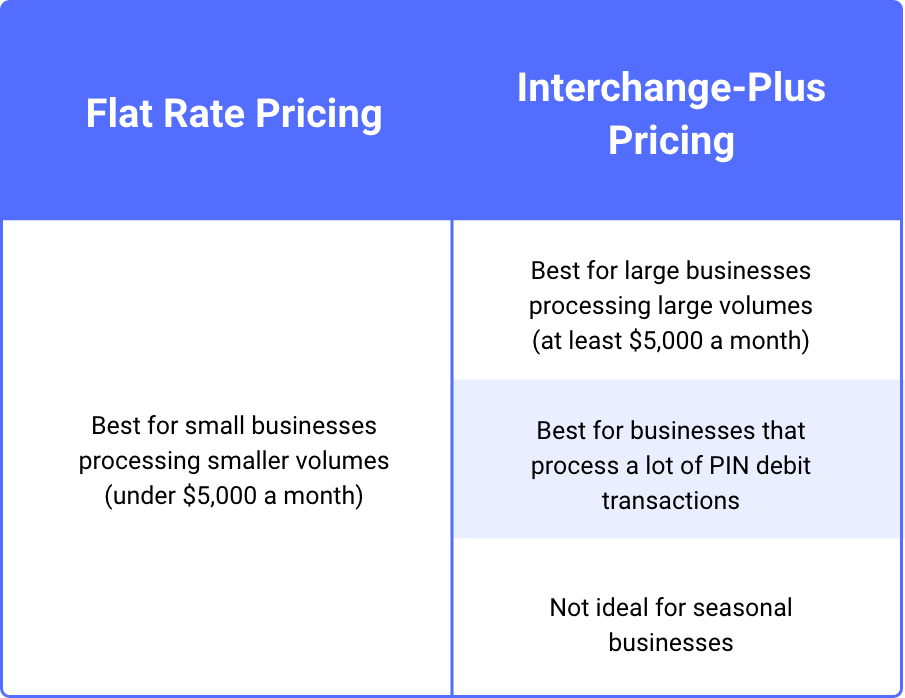

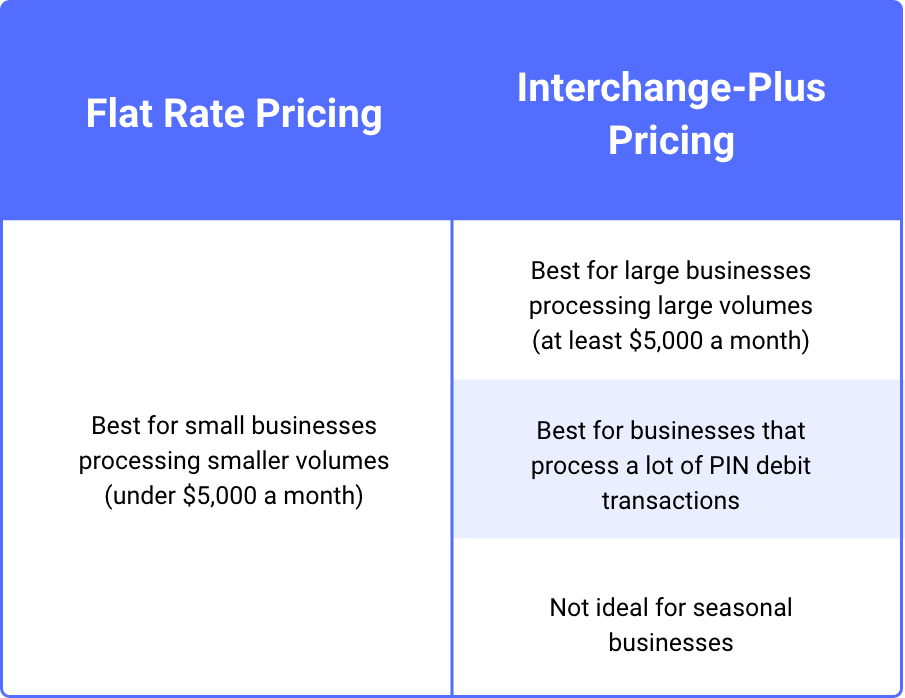

One of the reasons why businesses favor a flat rate pricing model is because of the fact that it’s easy to understand what you’ll be paying every month. However, as you’ve hopefully seen in this blog post, the flat rate pricing model isn’t best for every business.

What is the Best Pricing Model for Your Business? Should You Always Choose Interchange Plus?

Put another way, Is interchange plus better than flat rate?

At the end of the day, it depends upon the intricacies of your business. Generally speaking, interchange plus pricing is definitely best for bigger businesses processing a high volume of credit cards. This is because:

- The processor markup will be known

- You’ll pay the true interchange fee (i.e. you won’t be charged the same for both credit cards and debit cards, even though debit cards are less expensive)

However, while interchange plus offers a lot of benefits, it’s not always the best option for every business. Depending upon the size of your business and other factors, the benefits of choosing interchange plus over other models will be marginal.

Take a look at the chart below to see an overview of the best pricing model for your business:

Where Can You Get Interchange Plus Pricing?

A lot of the bigger names in the credit card processing industry exclusively use flat rate pricing while some exclusively offer interchange plus pricing. (Yocale, however, offers both and will match you with the best model for your business!).

Finally get on a pricing plan that actually makes sense for your business

Wrapping it Up

While it’s important to consider your pricing model, there are also other areas where you may be paying more than you otherwise would. This includes cancellation/early termination fees, monthly fees, American Express surcharge fees, authorization markups, foreign card markups and several others. This is the very reason we launched Yocale Pay: to reduce unnecessary payment processing costs). You can read more about Yocale Pay here.

Interested in seeing how much you can save with Yocale Pay? Tell us a few little details.