In today’s digital age, merchants rely heavily on electronic payment systems to conduct business efficiently. However, understanding the fees associated with processing payments can be a daunting task. One important metric for merchants to consider is the effective rate, which reflects the total cost of payment processing. In this blog post, we will delve into what an effective rate is, how merchants can calculate it on their monthly statements, and how Yocale Pay can assist in reducing processing fees to ensure rates remain under 1.5%.

What is an Effective Rate? The effective rate, also known as the effective processing rate, is a percentage that represents the total fees a merchant pays for processing credit and debit card transactions. It includes all costs associated with payment processing, such as interchange fees, assessment fees, transaction fees, and any other applicable charges. By calculating the effective rate, merchants can gain a comprehensive understanding of their overall payment processing expenses.

Calculating the Effective Rate: To calculate the effective rate, merchants need to gather specific information from their monthly statements. Here’s a step-by-step guide to help merchants calculate their effective rate:

Step 1: Obtain the Total Processing Fees – Locate the total amount of processing fees charged for the statement period. This information can usually be found in the statement summary or a dedicated section.

Step 2: Determine the Total Card Volume – Identify the total value of credit and debit card transactions processed during the statement period.

Step 3: Divide Fees by Volume – Divide the total processing fees by the total card volume and multiply by 100 to get the effective rate as a percentage.

Example Calculation: Let’s say a merchant had $50,000 in card transactions for the month, and the processing fees totaled $1150. To calculate the effective rate, divide $750 by $50,000, then multiply by 100:

Effective Rate = ($1150 / $50,000) * 100 = 2.3%

Yocale Pay: Reducing Processing Fees for Merchants: Yocale Pay is a payment processing solution that understands the importance of helping merchants optimize their financial resources. By partnering with Yocale Pay, merchants gain access to a range of tools and strategies to lower their monthly processing fees. In fact, Yocale Pay is dedicated to ensuring that the effective rate for its merchants remains under 1.5%.

How Yocale Pay Achieves Low Effective Rates:

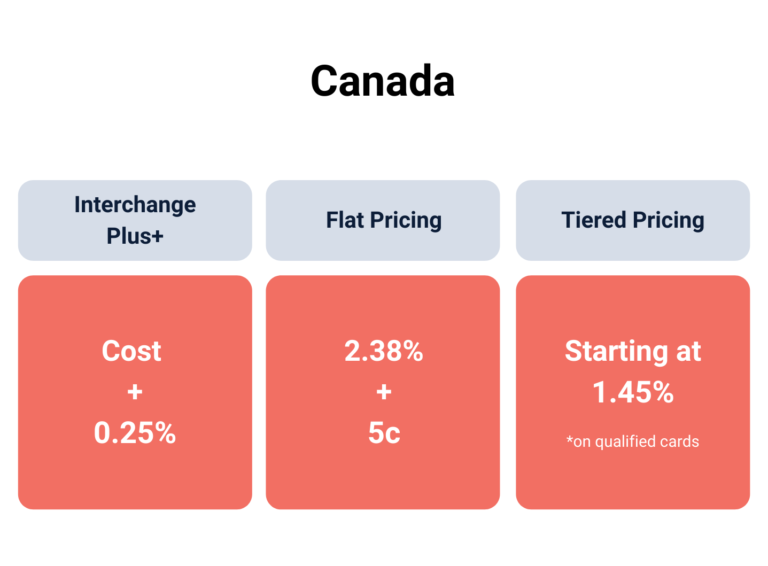

- Competitive Interchange Rates: Yocale Pay negotiates with card networks and financial institutions to secure competitive interchange rates, which are the fees paid to the card-issuing bank.

- Streamlined Pricing Structure: Yocale Pay offers transparent pricing with no hidden fees or complex structures, making it easier for merchants to understand and manage their payment processing expenses.

- Personalized Optimization: Yocale Pay’s team of experts analyzes each merchant’s transaction patterns and provides tailored recommendations to optimize their payment processing strategies and further reduce costs.

- Dedicated Support: Yocale Pay’s customer support team is readily available to assist merchants with any questions or concerns regarding their monthly fees and effective rates.

Understanding the effective rate is crucial for merchants to gain insight into their payment processing costs. By calculating the effective rate using their monthly statements, merchants can identify opportunities to lower expenses and optimize their business’s financial performance. Yocale Pay goes the extra mile by providing merchants with a suite of solutions and support to reduce their monthly processing fees, ensuring that their effective rates remain under 1.5%. If you find that your effective rate is higher than desired, reach out to Yocale Pay for assistance in lowering your monthly fees and improving your overall profitability.